Such reports aren’t entirely unfounded. With Sears, Macy’s and Sam’s Club shutting doors across the country (and the sad announcement of the Toys ‘R’ Us bankruptcy), the evidence is mounting in the case against long-term big-box retail survival.

Yet it’s highly probable that sources predicting the death knell of larger retail stores are woefully misinformed. Indeed, savvy market trackers indicate all signs point to a new age for big-box operations. Despite some worrying symptoms, it appears larger retailers are still maintaining a steady pulse and are poised for a healthy revolution.

But keep your eyes peeled, because this revolution may not be televised.

Big-box’s transition from stalwart business format to trendy niche enterprise has so far been flying under the radar. Still, in the shadow of Amazon and the e-commerce takeover, small, quiet changes have yielded hefty returns for old brick-and-mortar standbys like Costco and Target.

Curious as to how these once-doomed retail relics have nursed themselves back to health in a discreet-yet-effective way?

We’re here to show you.

The following are our top recommendations for keeping your big-box retail business’ heart pumping…even in the era of Jeff Bezos and the all-powerful digital marketplace.

1. Shift your focus away from sales and steer it towards your brand.

Sometimes your greatest asset isn’t the product you sell — it’s the company you keep. Take Costco, for example. Though sprawling sister retailers may be closing their doors, Costco’s resting heart rate remains sound, thanks in large part to the warehouse chain’s reliance on annual membership fees. Instead of generating revenue by playing the markup game, Costco reels in customers with tantalizingly low prices while compensating for potential profit losses with (relatively) small membership dues. This exclusive club strategy, The Motley Fool

observes

, “creates a loyal relationship [in which] the shopper knows he or she is getting a good value, which leads him or her to renew no matter how much or how little the membership was used.”

Costco seems to have circumvented the e-commerce problem by focusing more on attracting and maintaining a customer base than on raking in sales — and the results are astounding. Nasdaq.com reports a staggering

75% of Costco’s profits

to come solely from membership fees, with 2018 Q1 renewal rates holding at around 87% worldwide.

If you oversee an ailing big-box retail operation, it might be worth adopting the Costco cure. Try thinking a little less about your day-to-day transactions and a little more about your bigger customer picture. Implementing a membership plan is a good place to begin. Don’t be afraid to offer lower-priced goods and services; you can make up the difference with a modest cover charge. In addition, you may also want to divert your energies away from pushing products and more towards keeping a smile on your customers’ faces. (Hint: Extra-curricular activities such as Costco’s tried-and-true food sample stations will encourage more traffic, which will encourage more membership signups and, ultimately, give a major leg up to your bottom line.)

2. Maximize by downsizing.

While traditional retail is by no means dead, standard brick-and-mortar business is definitely undergoing a transformation…and we mean that physically as well as conceptually. The advent of e-commerce and the rising cost of real estate have forced big-box retailers to rethink how they use their square footage, and some brand names like Kohl’s, Target, Nordstrom, and Sears have therefore adopted a new spatial solution: go small or go home. As CNBC notes, this

downsizing tactic

involves “[realigning] physical footprints” and “keeping stores open in high demand markets”—that is, concentrating on smaller-scale locations that pack a larger sales punch. For any brick-and-mortar operator that wishes to grow, Thomas argues, “smaller stores are the future.”

Streamlined, bite-sized locations offer a chance to cut back on rent, shipping costs and embarrassing stock overages. Not a bad idea. Plus, these “small-box” stores promote a more intimate style of customer service by allowing for smarter, more efficient floor displays and, likewise, by freeing up time usually devoted to inventory management or general maintenance. Also not a bad idea, especially if you’re hoping to foster a strong ongoing relationship with your customers.

And if your extra square footage is producing some unpleasant business symptoms but you don’t want to “amputate” all that added space just yet, why not investigate a sublet? Kohl’s department stores — in a bid to minimize storefront space while still taking advantage of valuable real estate holdings — has repurposed much of its excess acreage by renting some of it out to a supermarket chain. The partnership enables both businesses to develop sleeker storefront blueprints and reduce spending at the same time.

Maybe your business is taking the opposite of this route, maybe your store will be subletting part of its inventory into another, possibly larger store. Setting up within another store doesn’t have to be a headache. A POS like Erply can you manage your stock at any location, even if that location isn’t necessarily

your

store. Because all of your inventory data is saved in your back office, Erply will even notify you when it’s time to restock you shops within other stores.

3. Remember: small and specialized wins the race.

If you make the wise decision to miniaturize your store space, your best bet is to make the most of what you have. After all, a small-box enterprise is only as good as the crowd it brings in. Consider Target’s latest business plan. The retail conglomerate has adapted to the economic climate not only by setting up smaller shops across the US (reaching a projected 130 locations by 2019) but also by customizing its product offerings to the respective tastes of each localized consumer base. Forbes

describes the move

as a “new take on hyper-local” that “uses customer data to choose merchandise that is likely to appeal to shoppers in a specific area.” Case in point: a relatively new Boston mini-location has been cleverly placed between Boston University and Boston College and is packed with snacks, dorm supplies, and affordable clothing -- all essentials to college students. Similarly, Ms. Slovak reports a suburban New York locale has chosen to highlight “a wide array of cosmetics and other beauty products, a limited selection of home décor, groceries, electronics, [and] toys. In other words, ideal fodder for the soccer mom on the go.

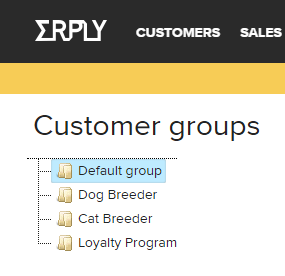

How will you identify local customer shopping trends, especially when managing many locations at once? Most POS solutions let you create customer profiles and save every traction that each customer has made and what store they made it at. Erply’s customer database includes many ways to organize this data by giving you the ability to organize customers into groups, filter customer purchases by location, and add internal notes to a customer’s card. It can be hard to find value when there’s so much data available, but Erply’s tools can help you plan for the future.

Specialized stores also serve as prime backdrops for what’s become known as the retail “experience,” a new trend predicated on the idea that shoppers will need to be seduced by a wealth of unique temptations if they’re going to keep buying at physical stores. A well-positioned satellite version of a big-box store is arguably the perfect place for an off-hours makeup tutorial, study session or coffee tasting designed to generate interest and introduce audiences to your brand. And Target CEO Brian Cornell seems to be in agreement. The Target honey-I-shrunk-my-department-store makeover is something Mr. Cornell sees as a “reimagining [of the] network of stores into hubs for commerce and community” (our emphasis).

Which brings us back to…t

he relationships your organization chooses to build.

Whatever treatment plan you opt to ease your big-box retail sufferings, be sure your primary objective is forging an everlasting bond with your consumer. So long as you nurture the emotional ties between you and your desired audience, half your work will always be done for you. If you’re looking for a magic potion to reverse your retail aches and pains, that’s as close as you’ll ever come.

Whether you stay big or reinvent yourself into small, we hope these suggestions provide you with some help. Best of luck on your road to big business recovery.