For whatever reason your inventory goes bad, it can be officially dealt with in a process called writing off inventory. This accounting procedure balances the loss of inventory in your general ledger, and if you manage your own inventory and books, you’ll need to familiarize yourself with the process.

When Good Inventory Goes Bad: The Two Steps to Writing Off Inventory

If you understand your inventory and you understand your customer, you can combine that knowledge with a keen focus on your numbers to figure out the value of inventory you may lose in any given period of time. Put as simply as possible, there are two main steps to writing off your inventory: estimating (premeditating) the loss and calculating the actual loss. Let’s look at each.

Step #1: Premeditate the loss

To make the premeditated loss official, you create a negative balance at the estimated amount of loss against your gross inventory worth.

For example, let’s imagine you run a holiday store that sells only Santa figurines (a poor business model, I’m sure, but a fun example). The holidays are approaching, so you’re moving a lot of inventory and tons of shoppers are rushing home with their treasures.

You have a gross inventory worth of $100,000 in Santa figurines, and you estimate that you’re going to lose one percent of your inventory. Your balance sheet would have your inventory asset written down as $100,000, and it would have a negative balance of $1,000 to account for the Santa figurines you’re pretty sure are going to get lost, broken, stolen, or simply not sold.

The net inventory you claim is then $99,000, and the premeditated loss is reported as a $1,000 expense.

This isn’t how it would look in your books, of course, but let’s break it down here to give you a better idea of the concept:

Gross inventory

$100,000

Estimation of inventory you’ll lose (premeditated loss)

$1,000

Net inventory you’ll claim

$99,000

Step #2: Write off the inventory using actual expenses

When your inventory does go bad, you can then write the cost off the books by balancing the gross inventory and the premeditated loss amount (previously reported as an expense) with the cost of the bad inventory.

Before your eyes glaze over, let’s apply this to our Santa store example.

Gross inventory

$100,000

Estimation of inventory you’ll lose (premeditated loss)

$1,000

Net inventory you had claimed

$99,000

To write off the actual inventory lost, you would start with the gross inventory of $100,000 and the premeditated loss as a $1,000 expense. However, let’s say that the actual value of the lost inventory is $900, not $1,000.

The gross inventory, then, needs to be reduced by the $900 loss. For our purposes, here’s what that looks like in practice:

Gross inventory

$100,000

Actual loss

$900

Gross inventory value

$99,100

As you see above, the gross inventory value is now $99,100. However, it’s not going to look like that in your balance sheet, since your balance sheet is a running tally of all debits and credits. Confused yet? This is why accountants exist. But if you’re still with me, great! Let’s talk more about writing off inventory.

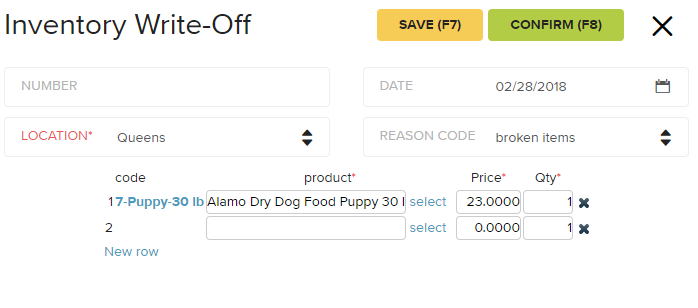

Erply makes it easy to track the write-offs of specific items. Broken or damaged merchandise is a common reason for writing off inventory items.

Writing Down Inventory

Writing off inventory with the above process is very similar to writing down inventory. Before inventory goes bad, is lost, or completely loses value for whatever reason, there is sometimes a period where the value is simply lower than it was before. When this happens, a company can record the value lower on the books as to more accurately reflect asset value.In the example above, the inventory had completely lost value. When writing down inventory, however, there is still some value there. Instead of recording a premeditated loss that is valued equivalent to the cost of the loss, the value is simply reduced by an appropriate amount. In the example above, we could say that the premeditated loss is only 70% of the goods, resulting in a premeditated loss of $700.

On the books, the write-down would be recorded as a debit to the cost of goods at $700, and a credit to inventory for $700. If your write-downs are substantial in size, it would be a good idea to record the debit under a separate “write down” account.

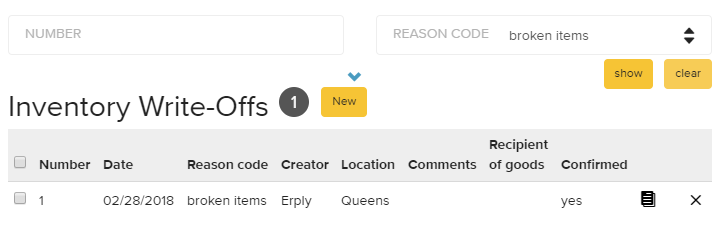

You can quickly review all your inventory write-offs, filterable by specific store location.