Introduction

It’s a simple fact – where business is easy, business will grow. “E-Estonia” is a term commonly used to describe Estonia’s emergence as one of the most advanced e-societies in the world – an incredible success story that grew out of a partnership between a forward-thinking government, a pro-active ICT sector and a switched-on, tech-savvy population. Services in the private sector such as internet banking and digital signatures have cut costs and speeded up trade like never before. Likewise, the public sector solutions used in Estonia, for instance electronic tax filing, e- business registry and the online availability of public records, have pared bureaucratic waste down to a bare minimum. Estonia has transformed itself into one of Europe’s business success stories of the last decade, mainly thanks to the sophisticated e-solutions available here. ERPLY is the latest technological achievement of the abovementioned E-Estonia which solutions manage billions of transactions annually with more than 200,000 users worldwide, supporting 18 different languages. ERPLY has been profiled in the Wall Street Journal, the Financial Times, BBC, TechCrunch, The Guardian and Fox Business as the product that can do for businesses the same that Skype did for telecommunication. The Wall Street Journal selected ERPLY as one of the top ten European tech-companies to watch in 2011. In more detail, ERPLY is a real-time POS (Point-of-Sale) and retail software system that manages all areas of retail organization, including point of sale, sales back office, inventory management, employee payroll, accounting, customer CRM, multi-channel/e-commerce and more, in a single integrated system.How can ERPLY help?

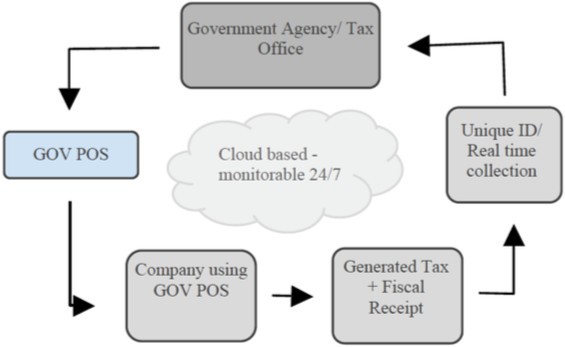

ERPLY understands that the implementation of governmental functions needs to be on the basis of a secured income and therefore, a well-functioned fiscal and taxation system is of great importance. This is why we have developed a vision which is called Government Owned Point- of-Sale (GOV POS) - a software working seamlessly between businesses and governments for efficient management control in areas of sales, bookkeeping and stock controls. The implementation of ERPLY ́s GOV POS will ultimately tackle challenges in areas such as tax evasion, slow growth of tax base and traders not issuing tax invoices. As a result, it is expected that the effective use of GOV POS in would revolutionize and modernize state’s fiscal systems and conclusively increase government revenue collections! One of many ERPLY’s GOV POS benefits is that it enables to have electronic receipts available to all companies. A new regime for the documentation by means of the electronic fiscal receipt which will allow substituting the paper documentation with electronic documentation. Digitally signed and generated documents will hold the same legal and tax validity as a receipt and other paper generated documents and can be monitored over the web by governments ́ agency responsible for tax collection. As a result it helps to eliminate the opportunity to hide formation of tax liability by private companies. Moreover, GOV POS automatically transmits tax information to the government agency responsible for the intake of government revenue; it has irreversible date mechanism; it issues fiscal receipts which are uniquely identifiable; it can be used as a stand-alone and configured into a network; it automatically saves configured data and records on permanent fiscal memory and has tax memory capacity that stores data for at least 5 years or 1800 day transactions.

Table 1. GOV POS explained

Conclusion

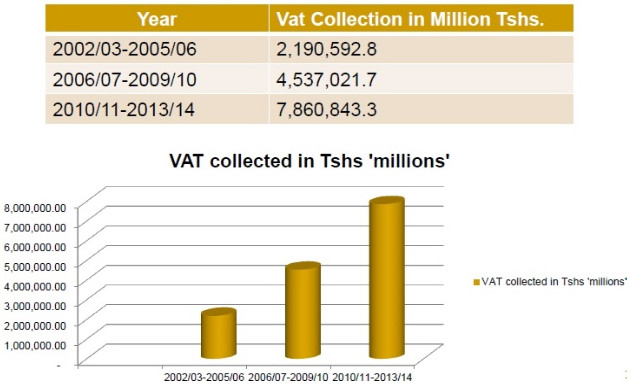

It is the duty of the government to narrow the excessively large gap between the planned tax revenue and revenue received. Therefore, it is of great importance to reform the fiscal system to establish sustainable tax return and GOV POS could be a tool to help carrying it through. A successful example of that could be found below. Just Four years after the introduction of GOV POS regime as a tool for revenue enhancement in Tanzania, we have witnessed a growth of about 73% in VAT revenue collections. Table 2 below shows the VAT collection performance before and after the introduction of GOV POS in Tanzania:

Table 2. Tanzania ́s tax revenue increase after implementing GOV POS.!

We, hereby, request for a meeting to introduce a vision that could change the fate of many countries for the better.

Please contact us to agree a suitable time for a meetinggovpos@erply.com