US companies’ aggressive approach towards finding and managing their customer's loyalty is quite different from Europe.

They mainly use highly active methods of acquiring and bringing back clients to their business. In addition, much of this process is automated and measurable. So it’s high time to change the European approach where the sale is still considered an inconvenience and receives little recognition. First, companies have already realized this. Rimi’s client offers terminal is probably the first real example of a solution aimed at lure back customers.

Where to start building customer loyalty

?

To knowingly manage customer loyalty a company must first understand basic terms, put in place a measuring device, determine goals and choose reasonably automated tools to ensure that keeping the clients goes smoothly. Responsible departments and teams have to be motivated to implement and constantly improve these processes. One key component is software solutions that will help to automate routine activities and in turn, save precious working hours.

Indicators that help measure the activities

Lead

/ new customer / returning customer

– the most expensive activity is to find new clients. Usually, advertising and other marketing techniques are being used to create interest among people who then come to try and hopefully buy the good or service. If there is a way to count these interested parties it is possible to calculate the cost of acquiring one new customer. Generally, it is more expensive than keeping or getting back an existing client who is familiar with the business.

For many retailers 25-50% of the turnover is generated by returning customers, it is even higher in more specialized fields.

CAC

– customer acquisition cost – that is the cost of acquiring one new client. This number can be used to explain the discount given to a customer or investment into customer event. Lower CAC shows the higher efficiency of the company’s sales and marketing department.

LTV

– lifetime value – it helps predict the value of each customer over their lifetime or turnover generated for the company. LTV is good for clarifying the investments into marketing and is also useful for creating a continuous customer service process.

ARPU

– average revenue per (paying) user – can be a bit of a software term, but is applicable to everyday business in order to show the average purchase value. It gives some information about estimated sales per customer to the sales team.

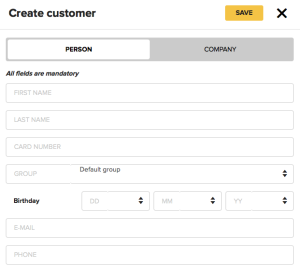

Does your current software enable you to collect basic customer information?

It’s in the company’s interest that after a contact with a customer and definitely after a sale to at least get the clients e-mail or phone number. This helps to automatically ask for feedback afterward. Even Google Docs or SurveyMonkey can be used to create a simple questionnaire to get relatively real-time feedback on customer satisfaction. In case of a bad response, it’s possible to ask additional questions and perhaps by being considerate attract back the customer who had an unpleasant experience. Client e-mails allow you to employ these methods automatically when using the modern point-of-sale software.

Instead of the overall guaranteed discount bonus points should be given instead.

This means that customers are rewarded a certain amount of points (e.g. 1€ = 1 point) after each transaction. If we take sports equipment stores in London for example, then most of them offer a 5% discount that doesn’t depend on customer behavior or consumed volumes. There is no clear way of increasing a given discount and therefore it doesn’t ensure customer loyalty.

Even if the discount is a little bigger after each purchase the customer would definitely buy more from that store.

Segmenting your customers based on their previous purchases allows you to send them targeted offers that meet the client interests and also avoids spamming. Customers are more likely to open e-mails that include deals that are important to them and the purchase rate (conversion) is higher than with general offers to overall client list. From there it is possible to assign customers their own price lists consisting of their favorite items and give special prices to those products. For example, every spring there could be an offer for new tires for bike enthusiasts and so on.

Bringing clients back to business automatically is probably the most unexploited opportunity. There are many ways to activate a passive customer. Most common is a so-called automatic additional discount for those who haven’t used the service for a while or who could be offered extra or spare parts or even maintenance. Businesses usually have slow periods during different seasons or at different times of day, automatic offers with special prices should be assigned to these periods to stimulate business. Printing coupons after each transaction aren’t also very customary. However, it provides a superb and targeted opportunity to make it more attractive for a customer to return next time and why not motivate them to share the coupon with a friend to get a bigger discount.

All in all, we can say that implementing typical techniques is easy using appropriate and functional business software. Such methods are already included in the standard package when developing modern solutions. Only things left are designing and testing company specific offers and models.

Extra 10-15% saving coupon that is intended for the clients friend might be times cheaper than the typical customer acquisition cost.

When the automation is complete the company has acquired a free marketing tool that might show instant results.