Layaway programs are a good way to keep customers, drive store traffic and foster consumer loyalty. After all, if your customers know that they can put products on layaway, then they’ll be less likely to pass up a chance to purchase that handbag or bracelet they’ve been eyeing or that refrigerator they need. When you decide to introduce a layaway program into your business, there’s plenty of things you need to know in order to offer a seamless process from deposit to pick up.

Layaways in Erply are directly accessible from the POS screen.

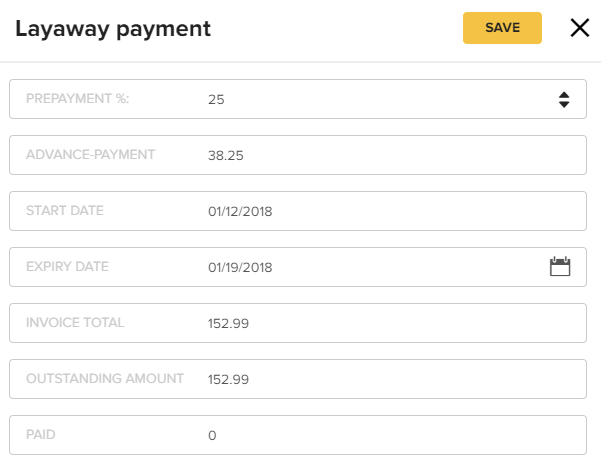

Collect prepayment and assign the date at which the layaway expires.

Know What You Want to Offer

Before you start advertising your layaway program, you have some decisions to make. What items are eligible? Are there any restrictions on the brands or kinds of items a person can finance through layaway? Which stores will offer layaway? These are the first questions you must answer before forging ahead. You’ll need to decide what you’ll offer on layaway and how they will be stored. It’s probably not possible or cost-effective to offer every item in your store under the program. Decide what types of merchandise or what price level will be available for layaway to keep the process streamlined. Then you can decide on the location of layaway items because you won’t actually be giving the item physically to the customer until they’ve paid for it in full. Once someone places an item on layaway, you’ll need to remove the item from your shelves or online inventory and hold it. Do you have a place for all of your customers’ layaway items? Will you remove the item from the sales floor and store it in your warehouse? You should state how and where the item will be stored upon going into layaway. Then it’s time to get into the legal nitty-gritty of the layaway program.

Know What’s Legal and Put it in Writing

It won’t surprise you to know that offering layaway in your store means that you must adhere to certain guidelines if you’re doing business in the United States. You’ll need to consider all of the legal aspects of layaway programs, including what’s required by the Federal Trade Commission, or FTC. There aren’t specific federal rules but there are FTC guidelines governing layaway; be sure you check into your state and FTC regulations to make sure you’re doing everything by the book. To find out what your state requires, you should check with the local Attorney General’s office. You will know exactly what you must put in your agreements, and what’s required of both you and the consumer. For instance, Ohio only requires written layaway agreements for purchases over $500, while California requires all layaway purchases have a written agreement. Avoid a legal hassle and unhappy customers later by reading requirements before you start up your layaway program.Start by making a layaway agreement that will lay out all the terms for your customers. Be sure you put your cancellation and refund policies in clear language, or you may be dealing with dissatisfied customers later. According to the FTC, if you don’t disclose important terms in layaway, you could be in violation of the Truth in Lending Act, also known as TILA. The important aspects to disclose to customers include the following:

Cancellation and refund policies

- Payment plans

- Item location

- Service charges

- Identification of layaway merchandise

The FTC states that there’s not a specific form of layaway, however, your state may have a required template. If your state doesn’t have a template, you can use the sample one provided by the FTC.

Other considerations that can come up with a layaway program may be a price guarantee. What if a customer puts your item on layaway then finds the item in question somewhere else and cheaper? Will you match the price? Scenarios like this one are come up all the time since consumers are savvy about saving money. Be prepared and make sure your staff is knowledgeable about store policies.

Promote the Layaway Program on All Your Channels

Some retailers have great layaway programs but their customers don’t know the program even exists. It’s essential that you invest time and advertising money to get the message out there. Announce the program on Facebook, Twitter, Instagram, Pinterest and other social media platforms, advertise in the local newspaper and display signs about the program in prominent places if you operate a brick and mortar location. Remember to Offer Layaway Online

If you have a good web presence, don’t forget to offer layaway to your online customers. U.S. online retail sales reached an estimated $459 billion in 2017. There’s no reason not to offer layaway to online customers. Inventory management systems and point of sale programs can help you keep track of your inventory, making the online layaway process seamless. If you’re planning to offer layaway just around the holiday season, be sure to roll out the program by late summer, since consumers will want to pay their purchases off by December.